BUSINESS

Through our business model which brings about economic rationality in solving social issues, we support those willing to work hard through the use of mobility.

In the emerging ASEAN countries, unlike Japan, it has been necessary to carefully review loans and leases due to the fact that there has been no institution in charge of providing individual credit information.

Due to this background, many categorized as the poor and low-income families are unable to purchase new vehicles. The only way for them to own vehicles is to purchase cheap old units which cause problems of loud noise and heavy exhaust emissions.

Such cases can be seen in many emerging countries, and it has been kept far from reaching a fundamental solution.

Amidst this situation, GMS has succeeded in creating a business model which focuses both on economic rationality and "sustainability" in the true sense. Our local subsidiary in the Philippines has chalked up steady achievements since it took off as our primary business. We plan to extend our reach in Asia, including Japan, and actively expand our business parternering with financial institutions.

To realize the ideal auto-society

Number of people who are declined through credit investigations and are unable to purchase vehicles:

1,700,000,000 people

There are 1.7 billion people in the world who are in need of cars to make a living, but are unable to access loans to gain job opportunities.

From the perspective of financial inclusion, we work to create opportunities for those motivated workers, first by providing finance towards one hundred million people by 2030.

-Percentage of those who are denied for auto-loans

| Philippines |  |

|

|---|---|---|

| Population | 105,341,062 | |

| Economic growth rate | 6.67% | |

| Average age | 24 years old | |

| Cambodia |  |

|

|---|---|---|

| Population | 16,323,953 | |

| Economic growth rate | 6.9% | |

| Average age | 24 years old | |

| Indonesia |  |

|

|---|---|---|

| Population | 266,357,297 | |

| Economic growth rate | 5.3% | |

| Average age | 28 years old | |

| Vietnam |  |

|

|---|---|---|

| Population | 96,356,744 | |

| Economic growth rate | 6.6% | |

| Average age | 30 years old | |

| Thailand |  |

|

|---|---|---|

| Population | 68,415,739 | |

| Economic growth rate | 3.87% | |

| Average age | 38 years old | |

| India |  |

|

|---|---|---|

| Population | 1,358,137,719 | |

| Economic growth rate | 7.36% | |

| Average age | 27 years old | |

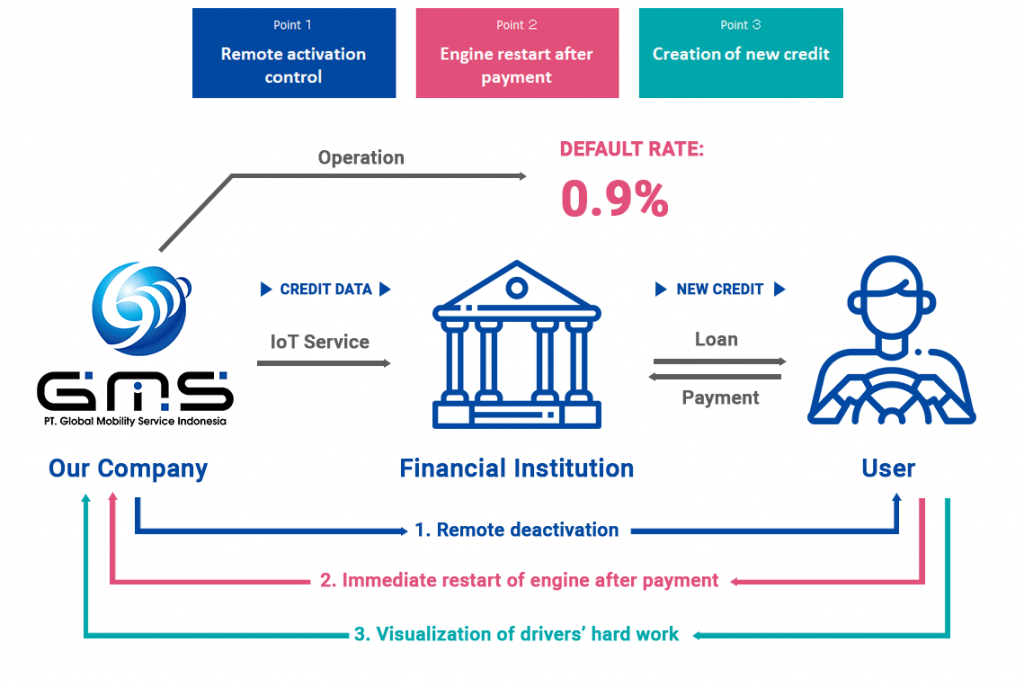

Our Business Model

-Our FinTech Service

Remote operation of any mobility is made possible with MCCS, our IoT device capable of installation on various vehicles/machinary. *Patented

Our platform allows real-time monitoring of vehicles, as well as linking with financial institutions through Open API. *Patented

We analyze the local needs of each country and cooperate with different companies/administrations to realize smooth operation.

– Business Scheme

Through the linkage we create between financial institutions, dealers, and contractors, GMS's FinTech services realize a system in which those who have been declined in credit investigations can gain access to loans.

Pemecahan Masalah

– We provide "win-win" values for multiple actors

Contractors

Loan/Lease

Will be able to buy cars they could not have bought in the past

Enriched lives

Financial institutions

Will be able to provide financial services to customers they could not have reached

Increased loan provision

Dealers

Will be able to sell cars they could not have sold

Increased sales quantity

Society

Will be able to sell cars they could not have sold

Reducing social inequality

– GMS Indonesia creates a better future

GMS Indonesia is a solution for those who want to work but do not have the tools to support their mobility needs. By using our services, they can improve the quality of their life and can bring happiness to their families. Our own service offers innovative car loans for customers who cannot get a loan because they are refused by conventional loan services.

Our services do not stop there, for those who have a good history of payments will get other opportunities such as education financing programs and so on. Together with GMS Indonesia, let's create a better future.

Our Partners

We cooperate with our stakeholders of each country to build up and improve each business. Through our pursuit for innovation beyond industries, we work to create a society full of new values and perspectives for companies and groups including those engaged in finance, automobile, infrastructure, as well as administrations.

– For Financial Institutions

GMS provides financing options to customers who, in the past, were unable to secure loans due to barriers caused by the traditional credit screening process.

– For Automobile Dealers

By partnering with financial institutions and leveraging our FinTech services, we enable dealers to sell cars to customers who were unable to pass the credit screening process adopted by traditional financial institutions. Partnering with GMS will open new sales channels for you.

– For Companies in Developing/Emerging Countries

GMS is currently making tremendous efforts in the Philippines, Cambodia, Indonesia, and other emerging countries by adapting to the needs of local customers. We are continuously developing the market by partnering with businesses based on our knowledge of local, cultural, and business practices by making use of our platform.

By pooling our knowledge and global intelligence, we are able to bring an innovative business model to the market.

By gathering our global knowledge and intelligence, we are able to bring innovative business models to the market.

– For Mobility Data Service Providers

Our MSPF platform is designed to collect and analyze mobility data from vehicles equipped with MCCS in numerous countries. GMS is currently offering OpenAPI to companies that wish to make use of our Big Data collected from mobility vehicles to develop applications and services.

– Our Business Partners in the Indonesia

We cooperate with the stakeholders of each country to develop each business. Through our pursuit for innovation beyond industries, we work to create a society full of new values and perspectives for companies and groups including those engaged in finance, automobile, infrastructure, as well as administrations.

Finance |

|

|---|

Dealership |

|

|---|